Business group calls for Irish tax reform body based on UK model

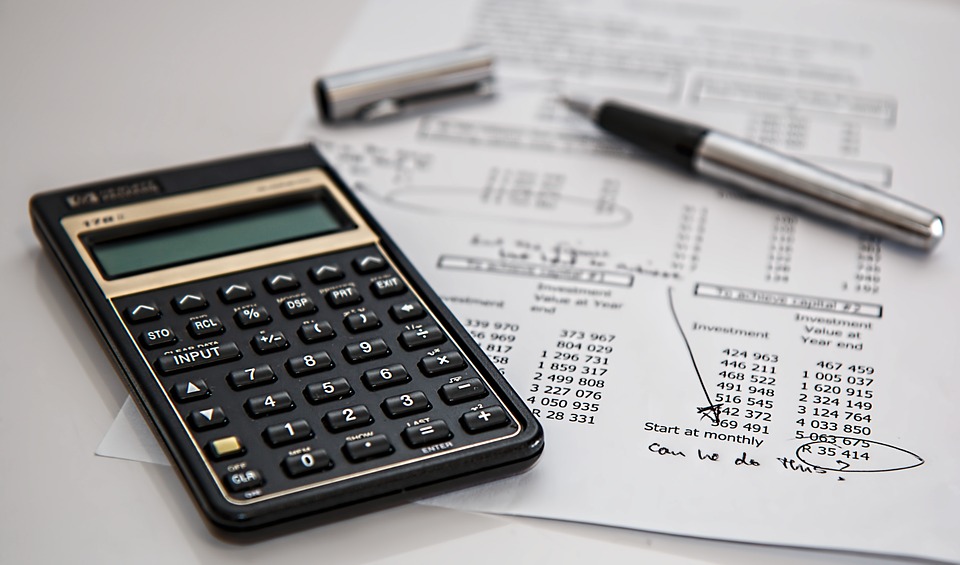

The Irish government should establish an Office of Tax Reform modelled on the UK’s Office of Tax Simplification, the British Irish Chamber of Commerce (BICC) has said.

In a submission to the Commission on Taxation and Welfare, the BICC said the proposed body would recommend and advise the government on how to simplify the “burdensome” nature of Ireland’s tax system on businesses.

It said the introduction of new obligations such as the Anti-Tax Avoidance Directive (ATAD) and the OECD’s Base Erosion Profit Shifting (BEPS) measures, without reform of the wider tax system, had led to unnecessary confusion and contradictions.

Paul Lynam, deputy director-general of the BICC, said: “The tax system continues to be a crucial factor determining Ireland’s future competitiveness. From helping to attract top international talent to our island to enabling indigenous businesses to grow, it can secure the recovery that has taken hold.

“But with global tax changes impacting upon our FDI model, it’s vital that we shore up Ireland’s global offering. Simplifying the complex tax system for businesses and addressing the tax burden on employees are two key tools in securing Ireland’s position as a location of choice for investment.

“Today too many indigenous firms find themselves restricted by overly complex tax rules which are in urgent need of reform. This is not only reducing their growth potential, but it is also choking off a potential source of revenue for the exchequer. By simplifying the taxes applied to businesses, Irish entrepreneurs can do what they do best – innovate and grow their businesses.

“The Commission on Taxation and Welfare has a unique opportunity to rebalance Ireland’s economic model. As businesses supporting €90bn in trade each year, we would encourage the Commission to be ambitious in reforming Ireland’s taxation system so that it supports high-value job creation and indigenous businesses.”